1. KNOWLEDGE OF COVERED WARRANTS

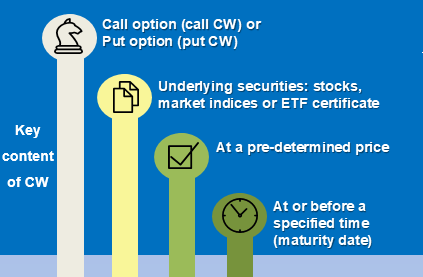

Covered Warrant (CW) is the security that gives the owner the RIGHT to buy or sell underlying securities to the warrant issuer at a predetermined price, at or before a specified time.

Key content of Covered Warrant

Basic information of a CW

.png)

2. TRADING WARRANTS ON VIETNAM STOCK MARKET

3. BENEFITS AND RISKS OF INVESTORS WHEN TRADING COVERED WARRANTS

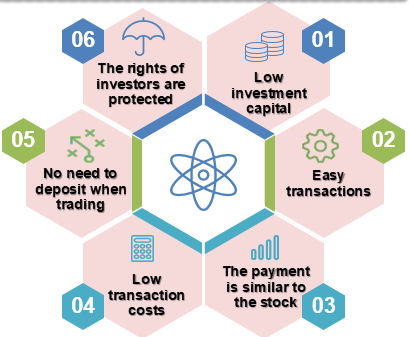

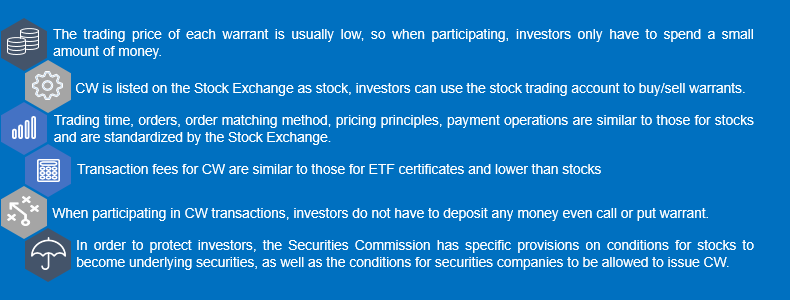

Benefits

High profitability ratios: Through financial leverage, CW is able to increase the efficiency (profitability) from 5 to 40 times.

.png)

Hedging: Given a predetermined loss as a purchase fee, CW is a useful hedging tool when investors are concerned about being negatively impacted by adverse market movements to their asset portfolios.

Easy access: Investors can easily register to buy CW at the time the issuer offers for sale in the primary market or buy on the secondary market after the CW is listed on the Stock Exchange. In addition, investors are not limited in ownership ratio except for no margin trading with CW

High liquidity: CW is always guaranteed to be traded and paid by the issuer. There is no case that investor cannot resell a purchased CW to the securities company issuing that CW.

Risks

Leverage risk: Financial leverage causes the investor’s profitability to increase sharply if the market movements are as expected. However, if the real market is not as expected, investor may lose more than investing in the underlying securities market, even losing all the investment capital (the amount of money for buying CW)

Underlying security risk: Fluctuations in underlying securities can have major impacts on CW prices. If the underlying securities are suspended or delisted, the CW will be suspended or delisted, too.

Price fluctuations: CW prices often change and are influenced by many factors such as interest rates, dividends, supply-demand, etc. This makes the CW price difference between buying and selling times of investors do not always create a profit.

Limited lifespan: Warrants always have a limited lifespan. Therefore, at the expiry time, investors will not be allowed to hold CW like stock investment but will be paid money or lose the fee for buying the initial warrants.

Issuer risk: The risk may arise when the issuer goes bankrupt or has financial difficulties leading to the failure to pay investors when the CW matures or the investor decides to exercise the rights.

-

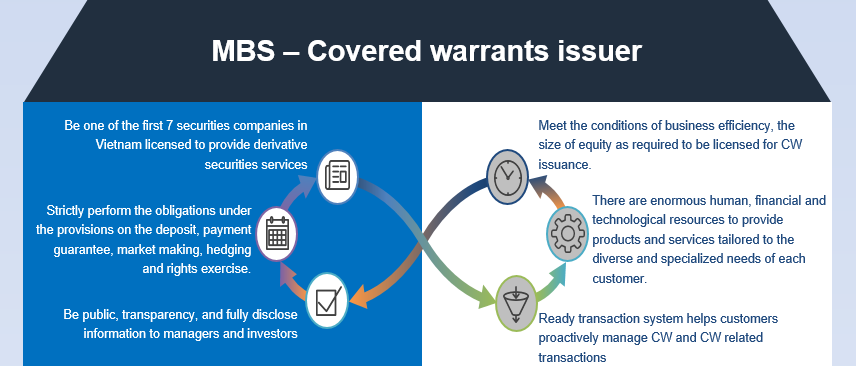

4. MBS - COVERED WARRANTS ISSUER